A lot of us dread tax season. The thought of filling out those complicated forms and deciphering all those numbers can be overwhelming. But fear not, because today I’m here to help you navigate the world of tax forms, specifically the W-4 form.

Understanding the W-4 Form

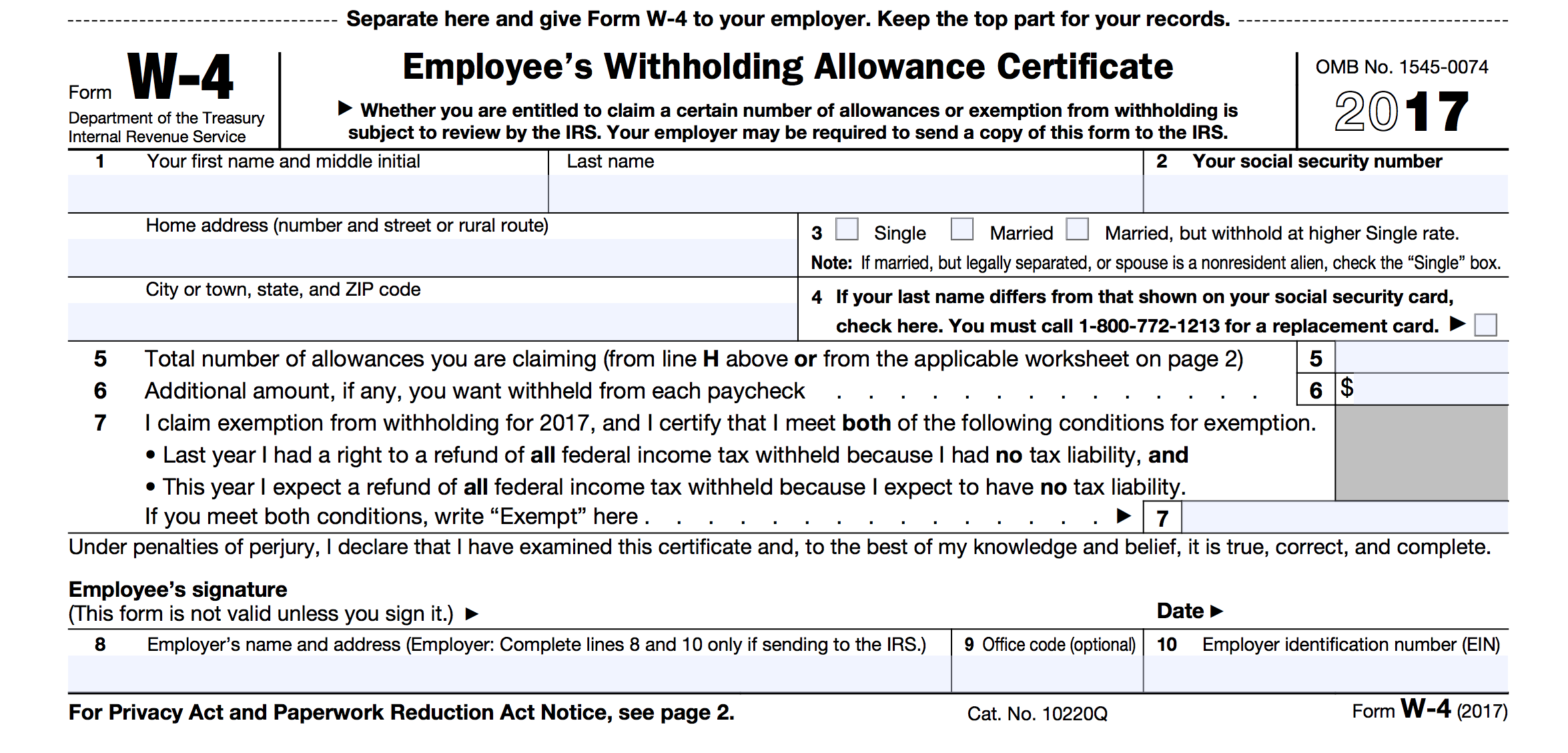

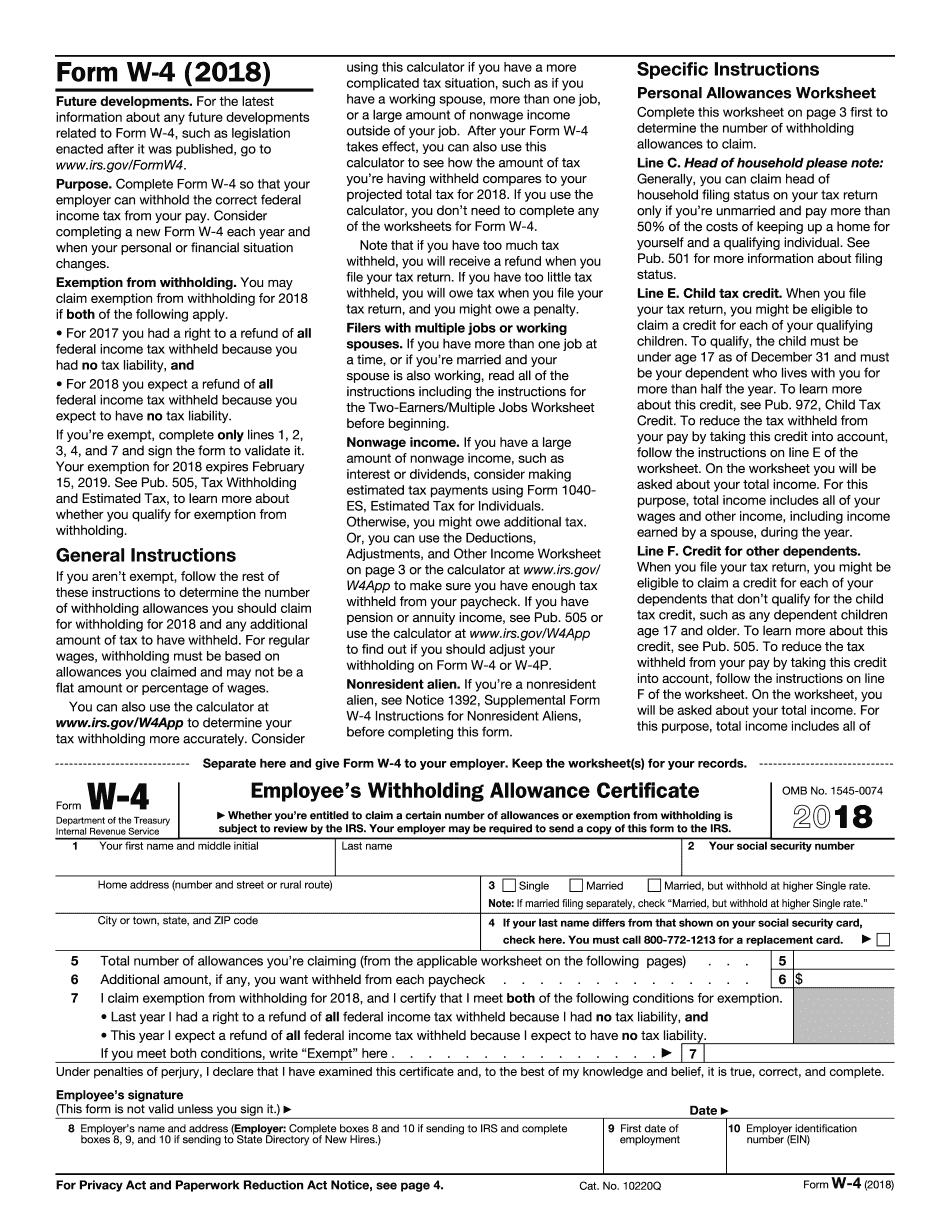

The W-4 form, also known as the Employee’s Withholding Certificate, is a key document that you need to fill out when you start a new job. This form determines how much federal income tax should be withheld from your paycheck. It’s important to fill it out correctly to avoid any surprises when tax season rolls around.

The W-4 form, also known as the Employee’s Withholding Certificate, is a key document that you need to fill out when you start a new job. This form determines how much federal income tax should be withheld from your paycheck. It’s important to fill it out correctly to avoid any surprises when tax season rolls around.

When filling out the W-4 form, you’ll need to provide information such as your name, address, filing status, and the number of allowances you want to claim. The number of allowances you choose affects the amount of tax that will be withheld from your paycheck. The more allowances you claim, the less tax will be withheld.

How to Fill Out the W-4 Form

Filling out the W-4 form may seem daunting at first, but it’s actually quite straightforward. Here’s a step-by-step guide to help you:

Filling out the W-4 form may seem daunting at first, but it’s actually quite straightforward. Here’s a step-by-step guide to help you:

- Start by entering your personal information, such as your name, address, and Social Security Number.

- Indicate your filing status. This can be single, married filing jointly, married filing separately, or head of household.

- Claim any dependents you have. This can include your children or other individuals who rely on you financially.

- Consider any additional income you expect to earn throughout the year that is not from your primary job.

- Review the worksheets provided with the form to determine the appropriate number of allowances you should claim.

- Sign and date the form.

Tips for Optimizing Your W-4

Now that you know how to fill out the W-4 form, here are some tips to help you optimize it:

- Use the IRS withholding calculator: If you want to be more precise with your withholding, you can use the IRS withholding calculator to determine the exact amount of allowances you should claim.

- Consider changes in your life: If you’ve recently gotten married, had a child, or gone through any other significant life events, you may need to adjust your W-4 form accordingly.

- Consult a tax professional: If you’re unsure about how to fill out the form or have complex financial situations, it’s always a good idea to consult a tax professional for guidance.

Remember, filling out the W-4 form accurately is crucial to ensure that you’re not overpaying or underpaying your taxes throughout the year. By taking the time to understand the form and optimize it for your specific circumstances, you can avoid any unpleasant surprises come tax season.

Conclusion

The W-4 form may seem intimidating at first, but with a little bit of guidance, you can easily navigate through it. Remember to review the form carefully, consider any changes in your life, and consult a tax professional if needed. By doing so, you’ll ensure that your tax withholding is accurate and avoid any unnecessary headaches down the line. Happy filing!

The W-4 form may seem intimidating at first, but with a little bit of guidance, you can easily navigate through it. Remember to review the form carefully, consider any changes in your life, and consult a tax professional if needed. By doing so, you’ll ensure that your tax withholding is accurate and avoid any unnecessary headaches down the line. Happy filing!